This series

goes deep with some of the most compelling figures in commercial

real estate: the dealmakers, the game-changers, the city-shapers

and the larger-than-life personalities who keep CRE

interesting.

Ben Harris founded Uncommon Capital Group to open up commercial

real estate opportunities traditionally reserved for institutional

players to private wealth investors.

He started the company in 2020, well before market conditions

sidelined many of those institutional players and opened the door

for private capital to fill the gap. Now, he’s leveraging the

latest advancements in technology to provide even greater value

for his investors.

Courtesy of Ben Harris

Ben Harris on a father-daughter hike in Vail, a favorite family

destination.

Courtesy of Ben Harris

Ben Harris on a father-daughter hike in Vail, a favorite family

destination.

“Real estate is an interesting industry,” Harris said. “It's been

around for many, many decades, and even though technology has

advanced, it hasn't really permeated its way into how the real

estate industry has done things. I'm not talking about just buying

and building deals, but really the entire ecosystem.

“At Uncommon, we've become kind of borderline obsessed with

artificial intelligence,” he added.

Harris spoke to Bisnow about leveraging AI in commercial real

estate, founding his company and forecasting the financial

environment for the year ahead.

This interview has been edited for length and clarity.

Bisnow: How did Uncommon Capital Group get its start, and where

did you see the need for this kind of platform in a lower-rate

environment?

Ben Harris: I founded Uncommon Capital Group in

2020 on the heels of two incredibly formative job experiences. The

first one was at a subsidiary of

Starwood Capital Group. I was the sixth employee, and at the time, we had a strategy

that wasn't yet funded. Fast forward two years and we went from

six employees to over 200 employees, from zero in assets under

management to over $7B in assets under management. It was this

incredibly formative experience, all entirely funded by

institutional investors.

Then I moved to another Chicago-based firm,

Origin Investments, which at the time was a very emerging manager with ambitions to

grow into a well-known brand. Two principals asked if I would

start and lead the investor relations and business development

team. At the time, I was 25 years old. I did not have

institutional relationships. I also really didn't have many

relationships with high-net-worth individuals, but I felt like I

could have some success there. After five years, we raised

hundreds of millions of dollars with that strategy, and I realized

just how underserved high-net-worth individuals, family offices

and wealth management firms were in the real estate private equity

space. Either they weren't seeing anything at all, they were

seeing a suboptimal deal at the country club or someone was

bringing them something that was pretty picked over.

I started Uncommon Capital Group in 2020 to change that. I really

wanted to bring an institutional experience to private-wealth

investors, and what that meant was curating a group of family

offices, wealth management platforms and ultra-high-net-worth

individuals and then curating select opportunities with that.

We're really trying to redefine private real estate investing.

Bisnow: Are these opportunities curated in a particular asset

class?

Harris: Our primary focus is in middle-market,

real estate private equity funds that are anywhere from $150M up

to $500M. In terms of asset classes, we still like some of the

main food groups, but we really like the niches. Historically,

industrial has been our largest, most favorite asset class.

But more recently, we've been working in industrial outdoor

storage. Historically, we did some in multifamily, but more

recently, we’ve been doing a lot more student housing. We've been

focusing on the niches because we think those offer really strong

risk-adjusted opportunities, especially in the middle markets.

Courtesy of Ben Harris

Ben Harris, founder of Uncommon Capital Group, and his wife, Thea,

enjoying a getaway in Miami.

Courtesy of Ben Harris

Ben Harris, founder of Uncommon Capital Group, and his wife, Thea,

enjoying a getaway in Miami.

Bisnow: What excites you about building a company from the ground

up?

Harris: Real estate is an interesting industry.

It's been around for many, many decades, and even though

technology has advanced, it hasn't really permeated its way into

how the real estate industry has done things. I'm not talking

about just buying and building deals, but really the entire

ecosystem.

At Uncommon, we've become kind of borderline obsessed with

artificial intelligence. I was an early adopter, using it more in

my personal life, but pretty quickly realizing just how powerful

it can be for businesses today. With the pace of innovation, I

realized just how powerful it will be in several months. I can't

even imagine what it will look like in a few years.

We mapped out all of our processes and figured out where

artificial intelligence could take something and make it faster

and give us back some of our own time. For example, we actually

have various custom GPTs for different tasks, and that's something

that I was able to play with on a weekend, wake up on a Monday and

do it, because it's my business and we're entrepreneurial. It’s

that part of the process that gets me really excited.

Bisnow: Does AI give you a bit of additional leverage to be able

to punch above your weight when using some of these technologies,

like these custom GPTs?

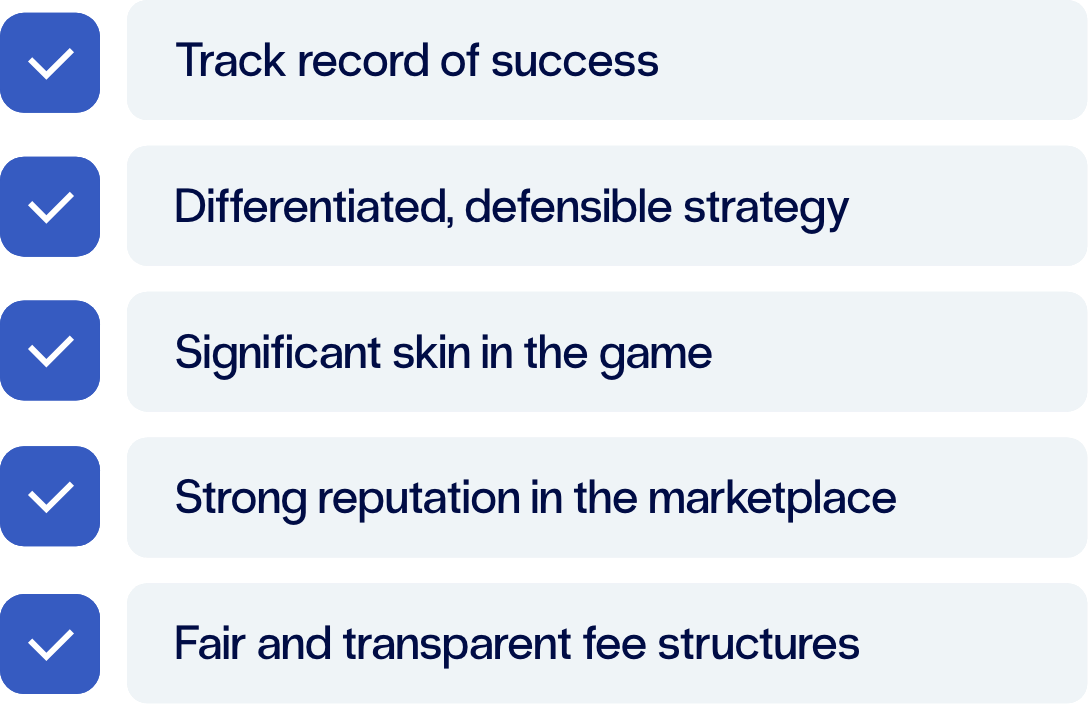

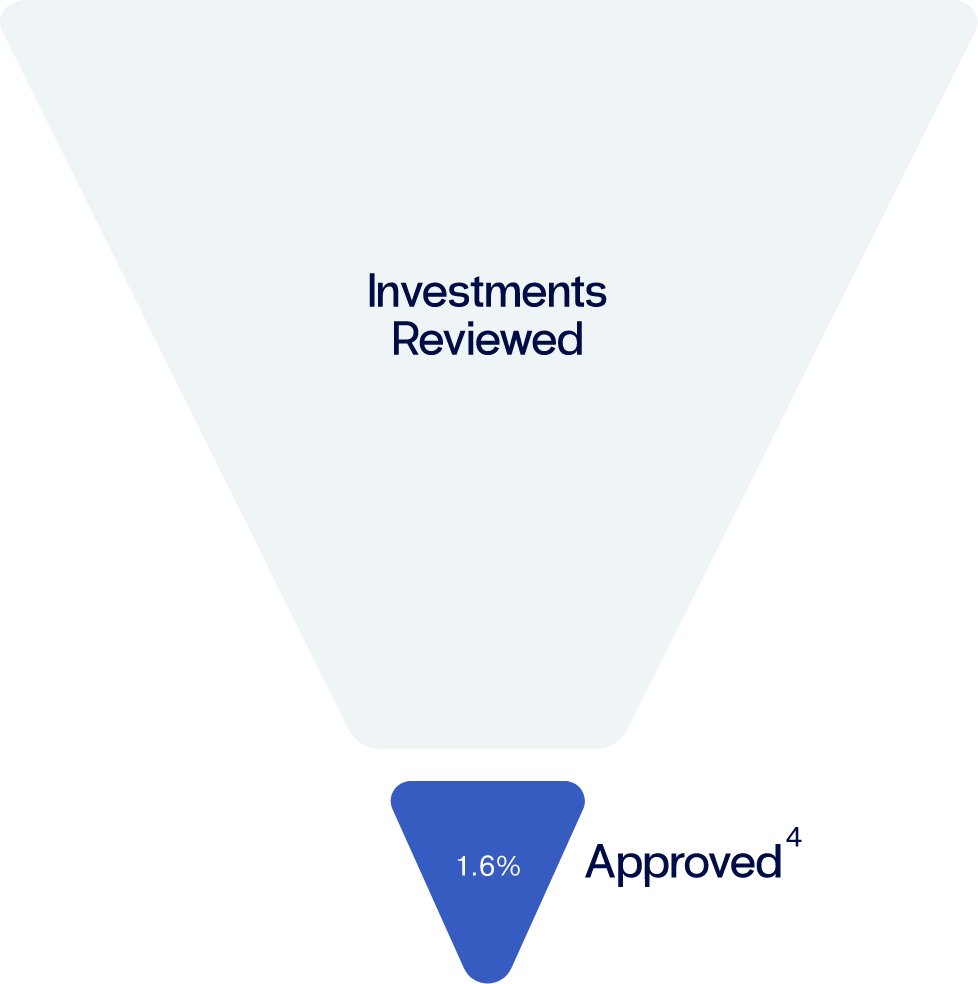

Harris: Our mission is to help private investors

do better in real estate investing. So with that always being our

North Star, I know that I want to see as much as possible and be

able to work through that funnel as thoroughly as possible so that

what drops out of the bottom are the best-curated opportunities.

That is a very time-consuming process. That’s why I just hired a

vice president of investments to help oversee that process with

me.

But there's a lot that can be done with leveraging artificial

intelligence. For example, we built a custom screener that we can

just pop in a deck and it will automatically score it for us based

on what we told it it cares about. We have seven table-stakes

criteria that just have to be met for us to even take the initial

call before we advance into diligence because that part of the

process is very time-consuming. Sometimes, investors say, “How'd

you meet with 400 groups last year?” That's because we can

leverage technology to do it. We can actually figure out who's

worthwhile spending time on pretty quickly by leveraging

technology.

Bisnow: How do your clients feel about the use of AI in your

workflow?

Harris: It's just an initial screener, and at the

end of the day, it is not running the full diligence process. We

are still leveraging our decades of experience and institutional

expertise to really run a comprehensive, multimonth diligence

process, but there are parts that artificial intelligence is

helpful for. What we do when we meet with current clients to give

them updates or meet with prospective clients, we pop open the

screen, ask them to send us any deck and we pop it in. And in

under five seconds, it's perfectly summarized for them. That's

just the high-level screener.

Now, you can't trust everything that you read in a deck.

Certainly, there's legal documents, you have to vet the strategy.

That today all happens outside of our GPT, and that's the process

that we run on behalf of our clients. That's really our huge

value-add to them. But certainly they're impressed by the

technology, and they understand we're in our earliest days of

building it. They can see where it might be going, and it does

help us stand out from the crowd. Not many groups are doing it,

and we're not doing it for show. It's actually effective.

Courtesy of Ben Harris

One of Ben Harris’s favorite activities is golfing with his

clients and friends.

Courtesy of Ben Harris

One of Ben Harris’s favorite activities is golfing with his

clients and friends.

Bisnow: What else do you utilize AI for?

Harris: Content. A huge part of our value-add is

educating our clients. The family offices, the wealth management

professionals, the ultra-high-net-worth individuals, they're

highly sophisticated, but they're also nonindustry professionals

to real estate specifically. So they're very curious and they're

investing large amounts of money. They want to understand the

inner workings. They aren’t investors who are just making

surface-level decisions. We do a lot of content, not to just say

“industrial is good,” but to actually explain the

supply-and-demand fundamentals, market by market — what tenants

are doing and getting into the guts of it. We do leverage

artificial intelligence to really break down some of those

industry reports.

Bisnow: How has company strategy evolved from when you started it

in 2020 to the higher-for-longer environment that we've settled in

to today?

Harris: Uncommon has become even more selective.

We still evaluate as many opportunities as we ever have, but

instead of working on maybe four to six opportunities per year, it

might be one to two per year. That's just what we find compelling.

In this higher-rate environment, real estate broadly does not

offer the same risk-adjusted returns that it used to, and less and

less opportunities are interesting to us. We really refuse to

lower our bar. It's just being ultra selective.

We also have been spending even more time with our clients.

Education is a very key part of what we do. I'm young, and I want

to be doing this for the next 30 years, not the next three years.

We are always taking a long-term mindset on relationship building.

We're breaking down what investors are already investing in and

how those investments are performing, what we're seeing generally

in the market and what we think might come next. It's super

worthwhile for me because it gets me out and gets a pulse on the

marketplace. And I like people, so it's fun to spend time with

them.

Bisnow: How do you see the financing environment evolving

throughout the rest of the year?

Harris: I never pretend to have a crystal ball.

I've worked for a lot of smart people over the years, and they

always said that, and I agree. Every time I think I might have it

figured out, something comes out of left field. If you're asking

me to make a forecast, I think we'll probably have a bit of a slow

year again.

It's earlier in the year, and so things can certainly change.

There's a lot of uncertainty with the new administration, but

they're also just a month into being in office. So maybe we get

some more answers and questions over the coming months.

But regardless of that, with the 10-year Treasury back near

all-time highs, it's really unclear what's going to change that

anytime soon. It will have a continued cooling effect on the

transaction market. Not that there aren’t interesting pockets of

investment opportunities, but it's just not broad-based like it

was in that late 2020, 2021 range. We might be signed up for

another slower year.

Courtesy of Ben Harris

Ben Harris on his annual ski trip with clients and friends in

Vail.

Courtesy of Ben Harris

Ben Harris on his annual ski trip with clients and friends in

Vail.

Bisnow: How have the Trump administration's policies come up in

conversations you’ve had in your day-to-day?

Harris: It's impossible to ignore what's going on

in the world because the world impacts investments and

specifically real estate, so they are part of my daily

conversations. People are just trying to digest in real time. Some

have an opinion. Some are just paying attention. Some want my

opinion.

It's too early to tell. It's been about a month, and I think

everybody is willing to see what happens over the next few months.

In the meantime, I do think a lot of investors are taking a

wait-and-see approach. They have the benefit of time. Nothing is

forcing them to act today or tomorrow. If they have a few months

to evaluate an opportunity, they'll probably use all of those

months.

Bisnow: Give us a bold prediction for the rest of the year.

Harris: My bold prediction is that every adult

American will be using artificial intelligence in some capacity by

the end of the year.

Bisnow: Are they going to be using

ChatGPT

or

DeepSeek?

Harris: They'll be using ChatGPT. It's an

American-based company, and it's highly accessible.

Bisnow: What’s your weekend routine or favorite weekend activity?

Harris: For me, weekends are all about family

time. I work a lot during the week and love to run around the city

with my wife and my one-and-a-half-year-old daughter, checking out

new restaurants, museums, parks when it's nice outside, and then

certainly take advantage of the me time during nap times. I make

it to the gym, I'll go golfing and I geek out way too often on

playing around with ChatGPT.

Courtesy of Ben Harris

Ben Harris on a father-daughter hike in Vail, a favorite family

destination.

Courtesy of Ben Harris

Ben Harris on a father-daughter hike in Vail, a favorite family

destination.

Courtesy of Ben Harris

Ben Harris, founder of Uncommon Capital Group, and his wife, Thea,

enjoying a getaway in Miami.

Courtesy of Ben Harris

Ben Harris, founder of Uncommon Capital Group, and his wife, Thea,

enjoying a getaway in Miami.

Courtesy of Ben Harris

One of Ben Harris’s favorite activities is golfing with his

clients and friends.

Courtesy of Ben Harris

One of Ben Harris’s favorite activities is golfing with his

clients and friends.

Courtesy of Ben Harris

Ben Harris on his annual ski trip with clients and friends in

Vail.

Courtesy of Ben Harris

Ben Harris on his annual ski trip with clients and friends in

Vail.